Arizona

Charitable Tax Credit

Taxes can be complicated.

Making a difference in your community doesn’t have to be.

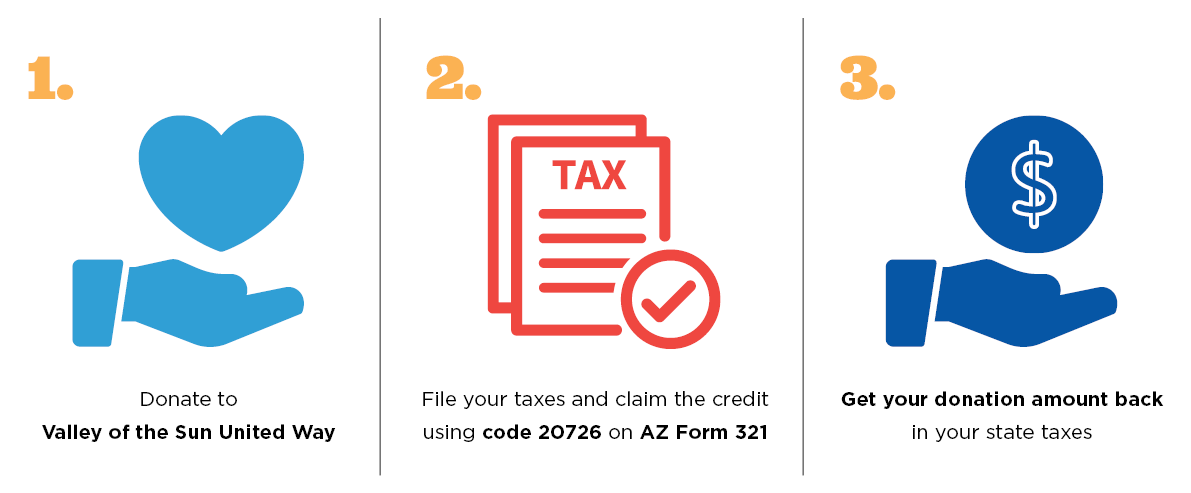

When you donate to Valley of the Sun United Way through the Arizona Charitable Tax Credit, you can reduce your state tax bill by the full amount of your donation—without itemizing your return! It’s a simple way to make a meaningful impact in our community.

The maximum credit donation amount for 2025:

$495 single, married filing separate or head of household; $987 married filing joint.

The maximum credit donation amount for 2026:

$506 single, married filing separate or head of household; $1,009 married filing joint.

Important Details

Valley of the Sun United Way is a registered 501(c)(3) nonprofit (EIN #86-0104419) and acts as an umbrella organization for qualifying charitable organizations (QCOs). When you designate your donation to our Arizona Charitable Tax Credit fund, 100% of your contribution goes directly to QCOs in our community.

To claim the credit, direct your donation, up to the limits above, to the Arizona Charitable Tax Credit fund designation. Use code 20726 when completing Arizona Forms 301 and 321 when filing your personal income taxes.

Please consult a qualified tax professional for advice specific to your situation.

“It’s like being reimbursed for doing something good for our neighbors in need.”

– Elizabeth L, Valley of the Sun United Way donor

FAQ’s

What’s the difference between a tax credit and a tax deduction?

Tax credits provide a dollar-for-dollar reduction of your income tax liability. Tax deductions lower your taxable income and are equal to a percentage of your marginal tax bracket. You cannot claim both a deduction and a credit for the same charitable contribution on your Arizona return.

Do I have to itemize deductions on my tax return to take advantage of this tax benefit?

Taxpayers do not have to itemize deductions to claim a credit for contributions to Qualifying Charitable Organizations (QCOs).

How does my gift to United Way qualify for the state tax credit?

Arizona law makes available a Credit for Contributions to QCOs for cash contributions to a QCO or an Umbrella Charitable Organization (UCO). A UCO is a charitable organization that collects donations on behalf of QCOs. Valley of the Sun United Way collects these contributions through its Arizona Charitable Tax Credit fund, and 100% of contributions to that fund are distributed to QCOs. To take advantage of this benefit with your donation to Valley of the Sun United Way, you must direct a portion of your gift—up to $495 for individuals and $987 for couples filing jointly in 2025 or $506 for individuals and $1,009 for couples filing jointly in 2026—to Valley of the Sun United Way’s Arizona Charitable Tax Credit designation.

Make Your Contribution Today!

The deadline for making a charitable contribution for the 2025 tax year is Wednesday, April 15, 2026.

Donate

Helps local food banks provide 260 meals for families experiencing hunger.

Provides high-quality children’s books for an entire classroom of young readers.

Supplies 20 much-need Heat Relief Kits and Snack Packs to those experiencing homelessness.

Matches a youth with an adult mentor who provides a trusting, safe, caring and stable relationship.

Engages a high school student in an internship, providing pathways to career success through skills training and meaningful work experiences.